What areas of the country are hot—and not—in the U.S. self-storage market as the business world shrugs off the effects of the coronavirus crisis? It’s a question many owners and investors would like to answer as they consider expanding their portfolios in 2023-24. Though the industry experienced record-setting performance during the pandemic and investment activity remains strong, nagging uncertainty about interest rates and inflation among other economic indicators should cause savvy professionals to tread carefully, no matter where they choose to grow in the coming months.

Industry observers believe a likely plateau of interest rates in the near future—which should be accompanied by a decline in self-storage capitalization (cap) rates—will coax some investors off of the sidelines. In August 2023, commercial real estate company Cushman & Wakefield (C&W) reported that transaction volume in the first half of 2023 took a year-over-year plunge of 57%. Nonetheless, self-storage remains a “top performer,” the company says.

Despite the higher cost of debt, cap rates for self-storage have remained relatively stable, averaging 5.1% in the second quarter of 2023, according to C&W. That’s up just 10 basis points from all-time lows. Furthermore, valuations have stayed mostly intact, averaging $165 per square foot, C&W reports. That’s down slightly from their 2022 peak; however, facility values are expected to improve as operators anticipate rental-rate growth amid an expected drop-off in new supply.

In fact, concerns about rental rates and new supply are at the forefront of investors’ minds today, according to Josh Koerner, broker associate at Weaver Realty Group, which does business primarily in Georgia and Florida. “In recent conversations with operators, there have been some reports of positive rent growth in select markets, but it is unclear if this will continue long term,” he says.

It may ease the minds of some investors to know that many self-storage projects in today’s pipeline probably won’t be built, according to Mike Mele, executive vice chairman of C&W and leader of its Self-Storage Advisory Group. “It’s very hard to get new supply to pencil right now” due to high costs for land and debt, he says.

Data provider Yardi Matrix doesn’t entirely agree. According to the third-quarter 2023 self-storage forecast it published, the company expects 2024 deliveries to exceed its previous supply forecast, then taper off from 2025 to 2028 following a widely predicted recession in 2024.

Look to the Sun Belt

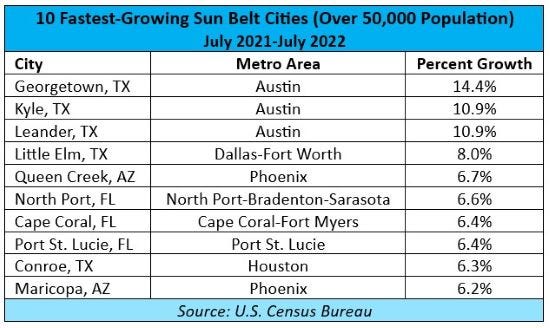

When the U.S. Census Bureau released population estimates in May 2023, the numbers told an irrefutable tale: America’s Sun Belt continues to boom. Among the country’s 15 fastest-growing cities, 12 are in that region. The Sun Belt is also projected to represent about 55% of the U.S. population in 2030, up from about 50% in 2019, according to a report from real estate investment company Clarion Partners.

It’s no wonder, then, that self-storage professionals point to that region as a hotbed of investment activity—now and into the foreseeable future. Across the 15 or 18 Sun Belt states (depending on whose definition you use), ongoing population and job growth bolsters the case for pumping money into the area, which stretches from Southern California to Florida. While growth rates vary among Sun Belt markets, the strength of the territory is undeniable. For example:

Self-storage real estate investment trust (REIT) Public Storage Inc. spent $2.2 billion in 2023 to purchase Simply Self Storage, whose portfolio is dominated by high-growth, Sun Belt markets.

Startup RecNation Storage, which already operates 52 boat/RV-storage sites in Arizona, Florida, Kansas, Missouri, Tennessee and Texas, reportedly plans to earmark billions of dollars to grow its portfolio, with the Sun Belt a key target, according to CoStar, a commercial real estate research and information company.

REIT National Storage Affiliates Trust reported that revenue growth in its Sun Belt markets outpaced others during the second quarter of 2023.

Aaron Swerdlin, vice chairman of commercial real estate company Newmark, says the Sun Belt is “almost a no-brainer” for self-storage investors. He cites Florida, Georgia, North Carolina, South Carolina, Tennessee and Texas as states on which to keep an eye. Specific markets to watch include Atlanta, Houston, Las Vegas, Nashville and Phoenix.

“Our observation is that if there’s alignment with an existing portfolio, that goes a very long way toward attracting capital,” Swerdlin says. “And if you don’t have some of those high-demand drivers like housing and employment, density and high rents per square foot are just as valuable.”

An analysis published in June 2023 by the Bank of America Institute supports Swerdlin’s outlook. It indicates that Sun Belt metro areas dominated domestic migration between the first quarter of 2022 and the first quarter of 2023. Only two non-Sun Belt metros (Cleveland and Philadelphia) appeared in the top 10. The other cities in that list are Austin, Texas; Tampa and Orlando, Florida; Dallas; Charlotte, North Carolina; Houston; Phoenix; and Las Vegas.

“I’m very bullish on the Sun Belt,” says Brett Hatcher, senior managing director of investments for commercial real estate company Marcus & Millichap. “Buyers are willing to be a little more aggressive in those markets, especially Florida.”

Mele says self-storage investors are engaging in a “flight to quality.” This means focusing on high-growth markets, usually in the Sun Belt, as well as areas with high barriers to entry. This strategy comes into play when things in the market become uncertain, he explains.

Secondary and Tertiary Targets

As self-storage investors seek to accelerate their buying activity, driven in part by potential rent growth, some may not focus on primary markets. Tom Flannigan, managing director of commercial real estate company Area CRE Services, says there’s way more opportunity in secondary and tertiary markets, based largely on the absence of intense competition for properties. But, that window of opportunity could soon shut as large investors, such as the industry REITs, enter smaller markets like Des Moines, Iowa, he says. Flannigan’s firm, which is an affiliate of Denver-based broker network Argus Self Storage Advisors, does business in Iowa, Minnesota, North Dakota and South Dakota.

Hatcher says self-storage investors are increasingly drawn to second and tertiary markets because of the ramped-up ability to run facilities via a “hub-and-spoke” model. Under this setup, sites in smaller markets can be operated—often remotely—in tandem with those in nearby primary markets. This approach can yield savings on operating costs, particularly labor. Smaller markets also are becoming more desirable because property taxes generally are lower there, Hatcher notes.

In general, secondary and tertiary markets are ideal for small-scale investors because REITs and large private-equity firms typically focus on the top 25 to 50 metros, according to Scott Schoettlin, managing director of commercial real estate company SkyView Advisors. Among the areas that may be worth exploring for acquisition opportunities are Charleston, South Carolina; Colorado Springs and Fort Collins, Colorado; Columbus, Ohio; Indianapolis; and Knoxville, Tennessee, he says.

Also tipping the scales toward secondary and tertiary markets is the fact that they’re frequently home to a high concentration of self-storage facilities owned and operated by families or small partnerships, ones that tend to enjoy more upside potential, even in a “sagging market,” Mele says. If an area boasts population, job and wage growth, and housing is solid, there’s no overarching drawback to investing in these areas, according to Swerdlin. In fact, some investors may be able to unearth hidden gems, including facilities that have been mismanaged, offer expansion opportunities or both, adds Koerner.

Finally, lower prices in secondary and tertiary markets are also spurring demand, as it’s difficult for most small-scale investors to compete for self-storage facilities with price tags above $2 million, notes Mele. A 35,000-square-foot property in a smaller market that an investor can scoop up at a cap rate in the upper 6% or low 7% range is “where the opportunity lies right now for buyers,” says Hatcher. Data collected by the investment specialist indicates the average cap rate was 6.5% as of Aug. 31, 2023.

General Outlook

Regardless of where you’re looking to purchase self-storage properties, Mele believes it’s a perfect time to buy because some investors—notably the REITs—aren’t aggressively hunting for acquisitions. Due in large part to stock prices that have slumped recently, the industry’s publicly traded companies must be selective about what they buy, adds Swerdlin. The industry’s two largest REITs, Extra Space Storage and Public Storage, are still occupied with absorbing their acquisitions of Life Storage and Simply Self Storage, respectively.

In a trend that’s likely to continue for a while, one-off deals are more prevalent than portfolio sales. In particular, single transactions priced $3 million to $15 million are gaining traction, says Koerner. “Smaller-bite deals are better today because they are easier to finance and less risky,” he explains. Few portfolios are even up for grabs these days, according to Swerdlin.

As the prospect of a recession looms, the historically resilient self-storage sector won’t necessarily outpace its current performance, but it’ll beat pandemic-battered sectors like office, retail and hospitality, Flannigan says. This should draw more capital to the sector. “If we did get into a recession or at least a downturn and the Fed starts moving to lower rates, I think we’ll start to see a lot more activity and much better pricing in 2024,” he adds.

Going forward, Hatcher cautions, self-storage investors shouldn’t expect the sort of heady times that the sector experienced during the pandemic. “It’s not like we’re in a crappy market. We’re going back to a normal market, and we have to realize this,” he says. “I always tell people that if you were trying to time the market perfectly, you missed the boat. And I don’t think we’ll see that boat for a long time.”

John Egan is an Austin, Texas-based freelance writer and content-marketing strategist who specializes in real estate, personal finance, and health and wellness. He’s the former editor-in-chief at SpareFoot (now Storable) and the author of “The Stripped-Down Guide to Content Marketing.” His work has been published by outlets such as Nareit, Wealth Management, Urban Land magazine, Bankrate, Forbes Advisor, Experian, Investopedia and U.S. News & World Report. To contact him, visit https://johnegan.net.